- #GOOGLE BUDGET CALENDAR UPDATE#

- #GOOGLE BUDGET CALENDAR FREE#

Vertex42 has a debt reduction calculator. While there are debt payoff apps to make a payment plan, a template might be your preference. If two loans have the same balance amount, make additional payments on the one with the higher interest rate first. Make extra monthly payments on the smallest debt balanceĪs you pay off your smallest debt balance, make extra payments for the next-smallest balance.Continue making the minimum monthly payment on each debt.List your debts from the smallest to largest remaining balance.This debt payoff strategy follows these steps: The second step is using the “Debt Snowball Method” to make extra debt payments. You’re likely familiar with Dave Ramsey’s Baby Steps if you are striving to be debt-free.

#GOOGLE BUDGET CALENDAR FREE#

There are free templates for other tasks, including a to-do list, calendar and travel planner.

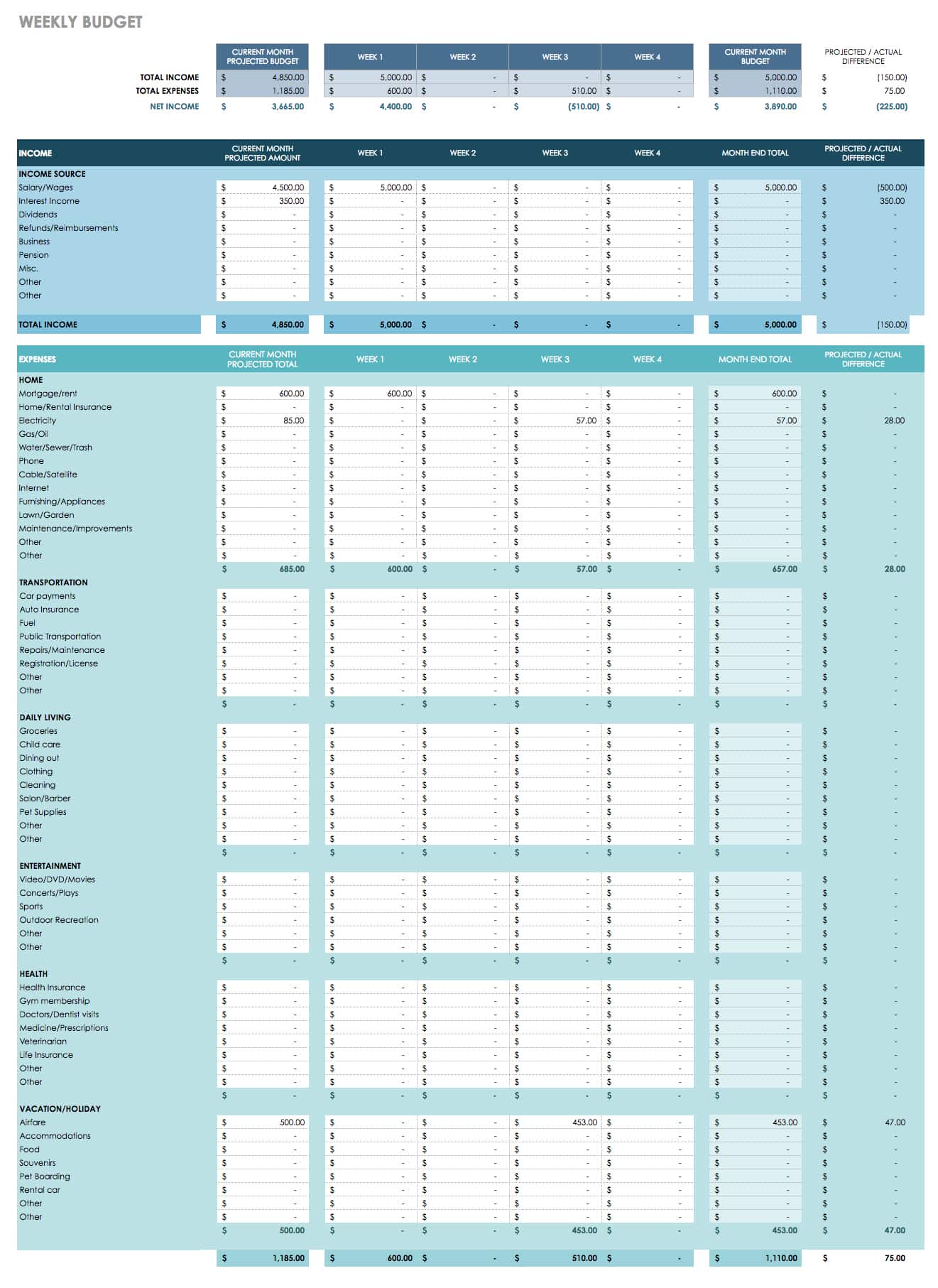

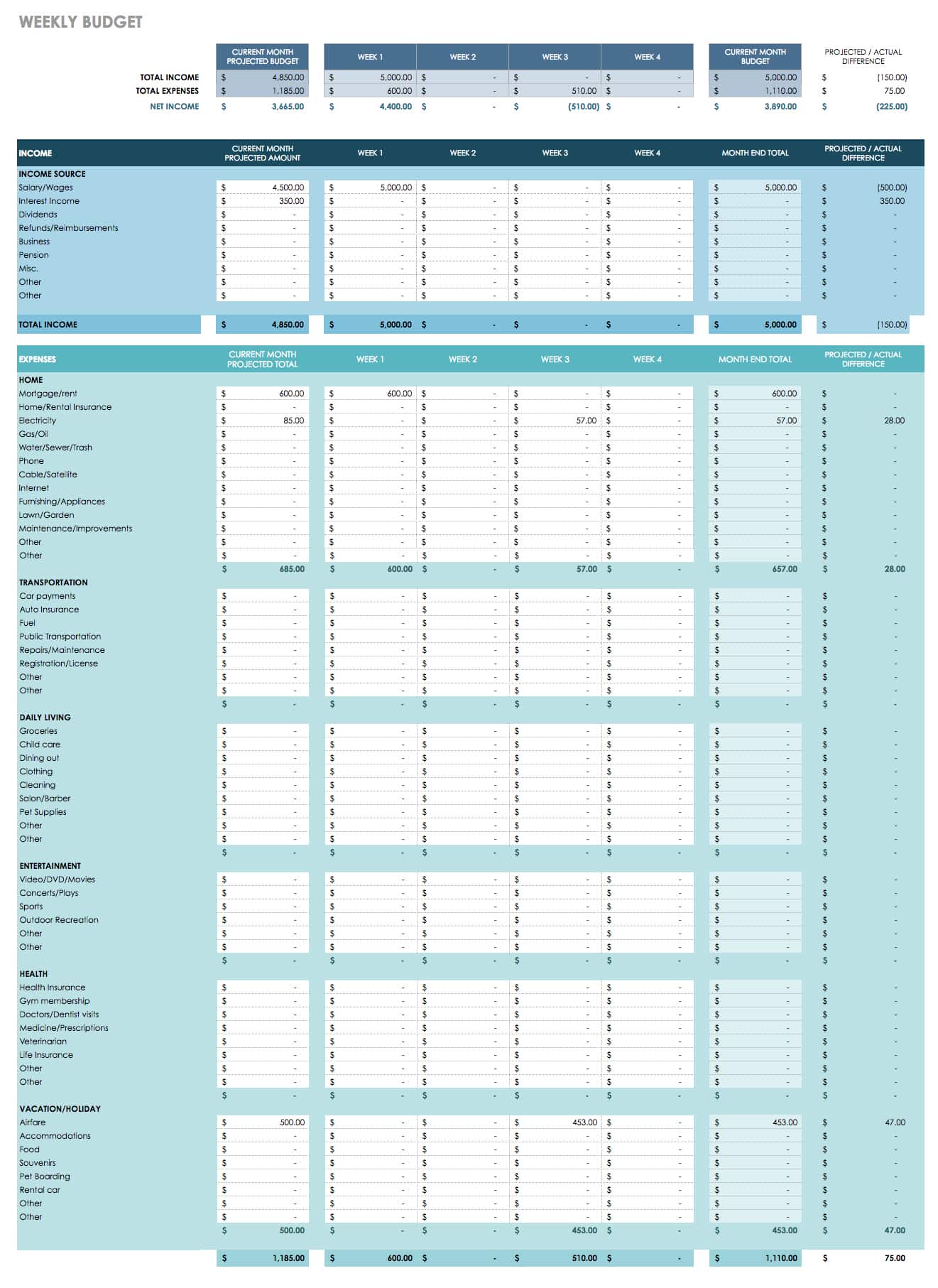

You will find both templates in the Google Sheets template gallery at. If you continue using these sheets for multiple years, you can compare your 20 monthly spending.

At the end of each month, you can copy these figures to the annual budget tracker to keep quickly comparing your month-to-month habits. You may decide to use the monthly budget template to track your daily spending. It’s possible to customize each template, but your options are relatively slim versus a Tiller Money spreadsheet.

Annual budget tracker – List your monthly income and expenses by category to track your monthly progress.īoth sheets include basic how-to instructions to create your budget. You can compare your planned and actual benefits by category. Monthly budget – Log individual income and spending transactions. These are the two default Google Sheets budgeting templates: However, you must be willing to input each transaction manually to have correct figures. These barebones templates can help improve your spending habits without breaking the bank. Google Sheets Budget Trackersĭid you know that Google Sheets offers two premade templates? Both are free and similar to the Microsoft Excel budget templates you may already use. This template has a tab for one person or two persons to compare each person’s income to their needs, wants and savings.ĭownload Here: 3. The 50/30/20 budgeting strategy can be easier to achieve if you live in a two-income household. Thankfully, there are simple ways to save money when you don’t have free time to pursue a side hustle. Separating your necessary monthly expenses (needs) from your wants can be challenging at first. The remaining 20% for savings and extra debt payments should include saving for retirement and boosting your emergency fund. Your “wants” might consist of streaming plans and date nights. The 50/30/20 rule divides your cash into one of three categories:Įxamples of your “needs” include your minimum monthly loan payments, insurance and living expenses. You’re also more likely to be able to afford a one-time financial surprise or temporary pay cut without going into debt. Only spending half of your income on needs means you’re not living paycheck to paycheck. The “50/30/20 rule” encourages you to only spend half of your monthly income on necessary expenses. Most budgeting templates are a zero-sum budget where you assign a budget category for each dollar you earn. Want a way to automatically pull your data into your spreadsheet from your bank? Check out Tiller which syncs with over 21,000 banks! 2. You can modify the income and expense categories to fit your personal spending plan. Expenses – Groceries, giving, “His” and “Her” spending, vehicle and gas, etc. Housing expenses – Mortgage/rent, utilities, internet, insurance, etc. Income – You and your spouse’s (if applicable) monthly salary. The Starter Budget takes a monthly look at these categories: However, the Starter Budget is easy to use if you decide to skip the video. There is also a brief YouTube video to help you start using the template. You can open the Starter Budget in Microsoft Excel or Google Sheets. Using Well Kept Wallet’s very own Starter Budget is free and saves you time. The digital alternative is manually logging each transaction into your spreadsheet.īuilding your own template can be effective, but it’s easy to overlook certain expenses. The simplest budget is writing your income and expenses on a piece of paper. These complex budgeting templates are “too smart.” #GOOGLE BUDGET CALENDAR UPDATE#

You may only need a basic budget template that lets you quickly compare your income and monthly expenses.Īdvanced spreadsheets may require too much effort to update or can be confusing to navigate.

0 kommentar(er)

0 kommentar(er)